Of all the strange twists in my life, this one might be the most unexpected (though not especially life-defining) one. My “brown thumb” is family legend, and being keenly aware of my shortcomings, I have always shied away from keeping plants around. Yet, somehow, within the last couple of months, my home has become a veritable greenhouse. At last count, we had twenty plants, not including the half dozen cuttings in various stages of growth.

How?

Contrary to common familial misconceptions, I actually really like plants. I am not overly fond of the outdoors (bugs, too many of them), but I like indoor greenery. Having spent a lot of time lately combing through interior design books, I came to realize how much of a difference plants can make in terms of making a space feel warm and inviting and, well, alive. In the past, I might have been tempted to recreate the same effect with fake greenery, but I’ve reached a stage of my life when I don’t want fake anything in my life. It’s the real deal, or nothing.

When I switched jobs last year, a couple of assistants at my old firm gave me a potted plant “bouquet” as a farewell gift, with a promise to call me weekly to remind me to water it. I’m sure you can guess why. Well, as it turns out, the promised calls didn’t happen (more’s the pity) but – in another unexpected twist – I managed to keep those plants alive, all by myself, for over a year. Granted, we are talking about a bunch of pothos and philodendron (aka as indestructible as plants get, short of bamboo), but still. I felt emboldened by this minor success, possibly to an unwarranted degree.

I decided it was time to reconsider my stance on the keeping of plants.

As my mom sagely noted after the fact, I am not a person who enters upon a new hobby with anything less than full steam. This is true. [It’s why my hobbies tend to be either unqualified successes or terrible failures which are never mentioned again. Now that I think about it, this post may be premature. Ahem.] I tentatively bought a few plants at IKEA and Home Depot, but quickly went all in once I discovered a proper plant nursery within 10 minute’s drive from our house. They know us by name there now. Their “tropical” greenhouse is a plant-lover’s delight, and even after my recent buying spree, I still have a wishlist that’s a mile long. I may have told my husband that he should be looking for my next Christmas/birthday/anniversary present there. See, my mom’s not wrong: I am intense.

[Lest you think I am kidding, I also bought a couple of books on plant care, a moisture/light/pH meter, a cute watering can, soil, fertilizer, you name it. And I am now following several plant care IG accounts.]

We are a pet-free home due to my husband’s allergies, so I have channeled all my extraneous attention upon the plants. The kids and I gave them all names, and I have found myself legit talking to them on more than one occasion; sometimes, the kids follow suit and it is the cutest thing ever. I am constantly worried about how much light and/or water they’re getting and/or not getting, and I can tell you that, as far as that goes, being a plant “mom” is a lot more stressful than I anticipated. But there is also nothing like the pride one feels when a new leaf unfurls. In fact, when Augustus (our fiddle leaf ficus) showed signs of a new leaf, I went all Sally Field in the middle of my living room – “you like it here, you really like it here!” *cue tears of joy*

Ahem.

You may think I am being overly dramatic, but I assure you that I am embellishing by no more than 15, 20% at most.

Anyway, I thought I would formally introduce our current plant family:

The aforementioned Augustus (his new leaf is still “cooking”).

This is Geraldine, our very first plant. She recently unfurled TWO new leaves in one week. Another leaf is on the way. The small pot on the shelf is Arthur.

These are (left to right) Arnold, Ruth and Leopold. Arnold is part of my original “plant bouquet”. I split the various offshoots into 2 pots when I brought the original container home from the office this summer; the other half is now Arthur (see above).

These are (left to right) Phinneas, Helga, and Winston. By way of full disclosure, all of our plants have middle names – which I have not included here for brevity – except for Helga. We got her at the Devon Botanical Gardens, and she is a Sedum Voodoo plant. My husband also likes to call her the Red Baroness.

These are (left to right) Evelyn and Luella.

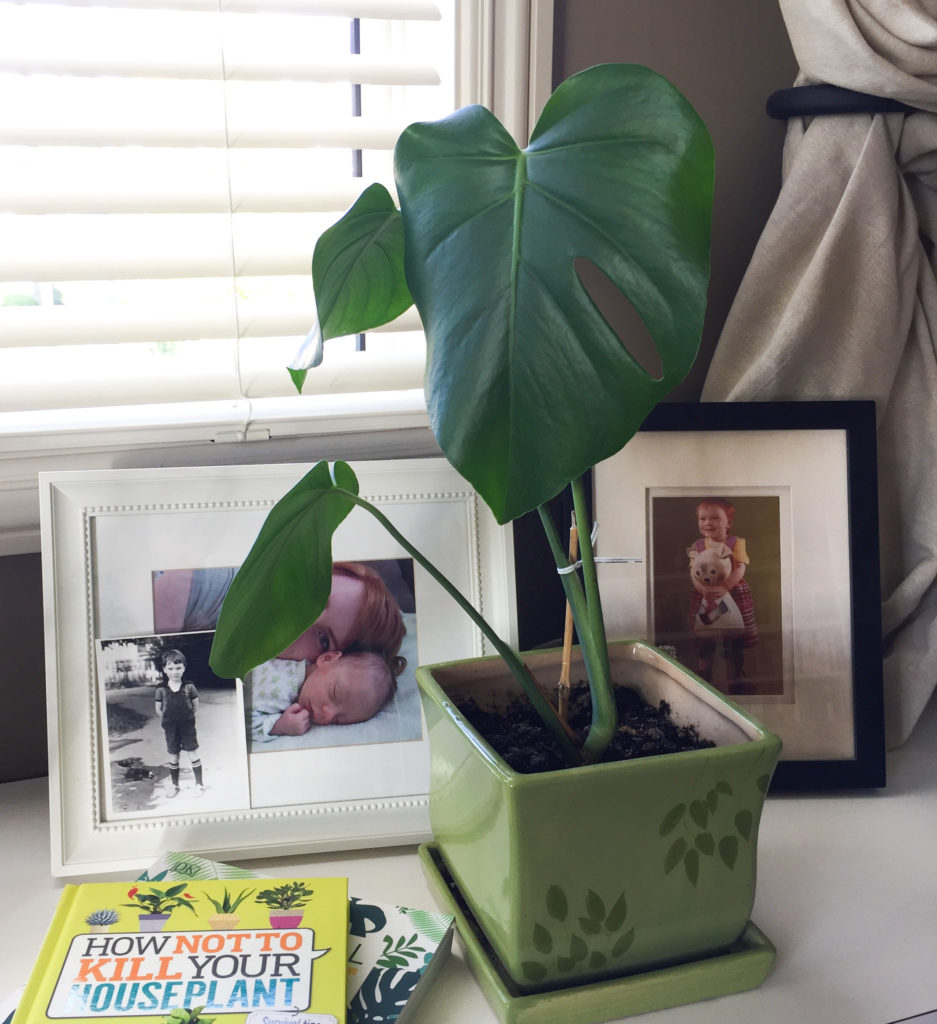

This is Frederick, who came to us from a friend. Frederick is a Monstera plant, and is named after Frederick the Great, aka Barbarossa, aka Stupor Mundi. I am hoping that encourages him to grow as large as the cheeseplant we used to have in my childhood apartment. My mom is still traumatized by that plant, but I have nothing but fond memories of our living room “jungle”.

Lastly, this is our succulent garden. I call this my “needles corner” – all prickly things and needlepoint. For some reason, most of these remain unnamed. The tall silver lantern cacti have been collectively nicknamed Mr. Fuzz, but that’s about it. We did have a flowering event a few weeks ago, which was extremely exciting:

Sadly, these blooms (there were two) only lasted one day. I am cautiously optimistic that we will see them again next year.

In the meantime, if you have tips, tricks or general words of encouragement, let me know in the comments.